Leverage Financial Calculators to Manage Your Business Growth

As a business owner, it’s important to understand the financial health of your company. The most effective way to do this is with financial calculators. Not only can you use these calculators for managing your personal net worth, but you can also use them for inventory, small business loans, commercial real estate loans and business equipment loans. Read on to find out how each of these types of calculators can help you manage your business growth.

Small Business Loan Calculator

A small business loan calculator helps entrepreneurs assess their current financial situation and determine whether they qualify for a loan or not. It takes into account factors such as credit score, income, debt-to-income ratio, repayment term length and more in order to calculate an estimated loan amount that could be available to them should they decide to apply for one. Using this information will help entrepreneurs decide if taking out a loan is the best option for their current financial goals or if there are other options available that could be more beneficial for their long-term success.

Inventory Calculator

An inventory calculator allows you to track the products that your company sells or services that it provides and determine their value over time. You can then use this data to make better decisions when purchasing new items or services and ensure that you are stocking the right items at the right price points in order to maximize profits. Knowing how much stock you have on hand at any given time is also essential for forecasting future needs and ensuring customer satisfaction.  Commercial Mortgage Calculator

Commercial real estate loan calculators are used by entrepreneurs who own commercial property who want to gain access to additional funds for expanding their businesses or improving existing properties in order to increase rental income potential or attract more tenants/customers/clients etc.. These calculators take into account factors such as rental income potential, current market values, interest rates, repayment terms etc., in order to provide an estimated amount that could be borrowed against a particular piece of property should an entrepreneur choose to apply for a loan against it.

Net Worth Calculator

Understanding your personal net worth is essential if you want to know the financial status of your company. A personal net worth calculator will give you a comprehensive overview of all of your assets and liabilities. This includes things like bank accounts, investments, real estate holdings and any debts that you may have. This type of calculator will help you understand where and how the money, assets and liabilities are distributed. Most lenders would also require a Personal Financial Statement

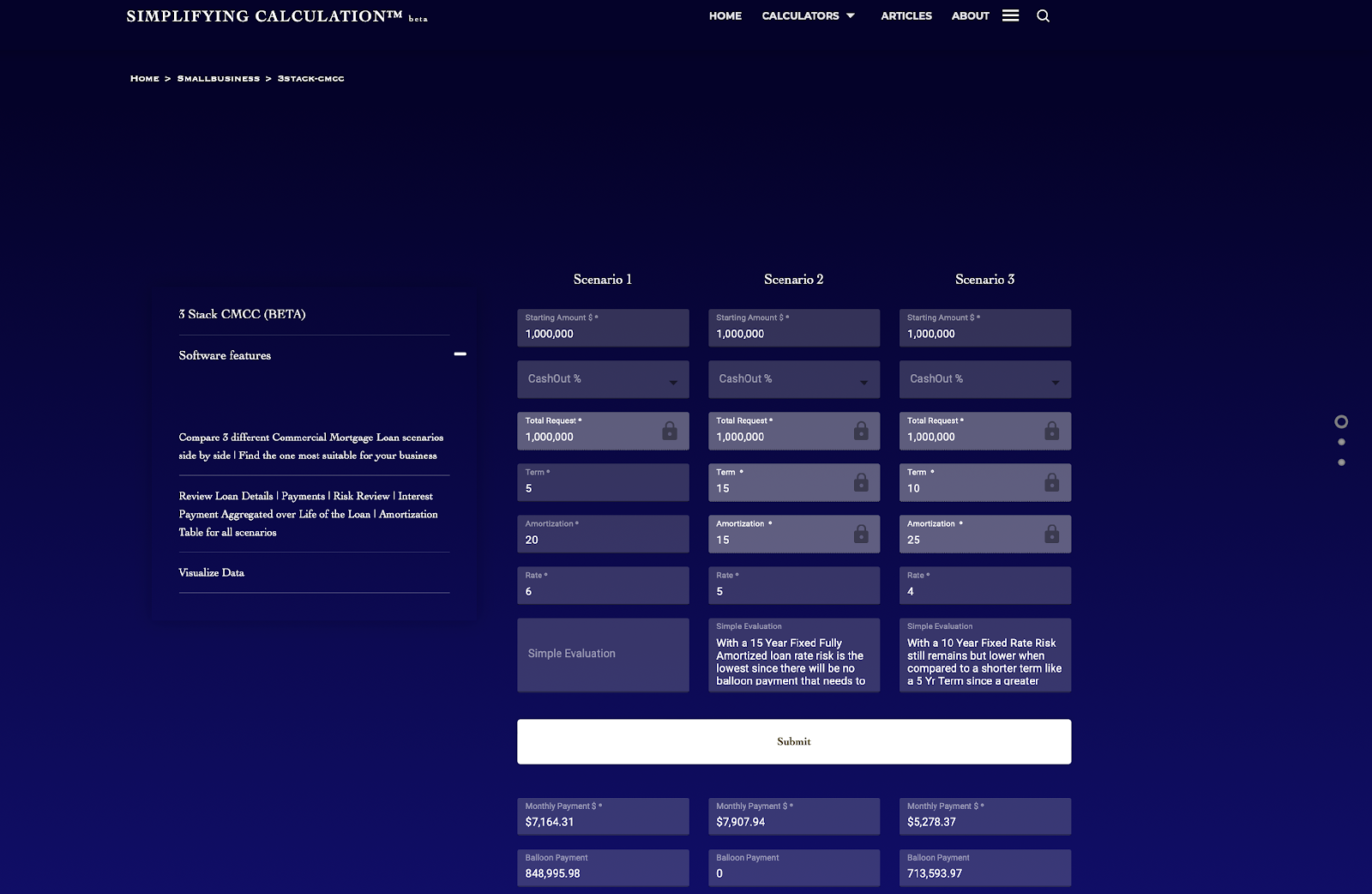

Commercial Mortgage Calculator

Commercial real estate loan calculators are used by entrepreneurs who own commercial property who want to gain access to additional funds for expanding their businesses or improving existing properties in order to increase rental income potential or attract more tenants/customers/clients etc.. These calculators take into account factors such as rental income potential, current market values, interest rates, repayment terms etc., in order to provide an estimated amount that could be borrowed against a particular piece of property should an entrepreneur choose to apply for a loan against it.

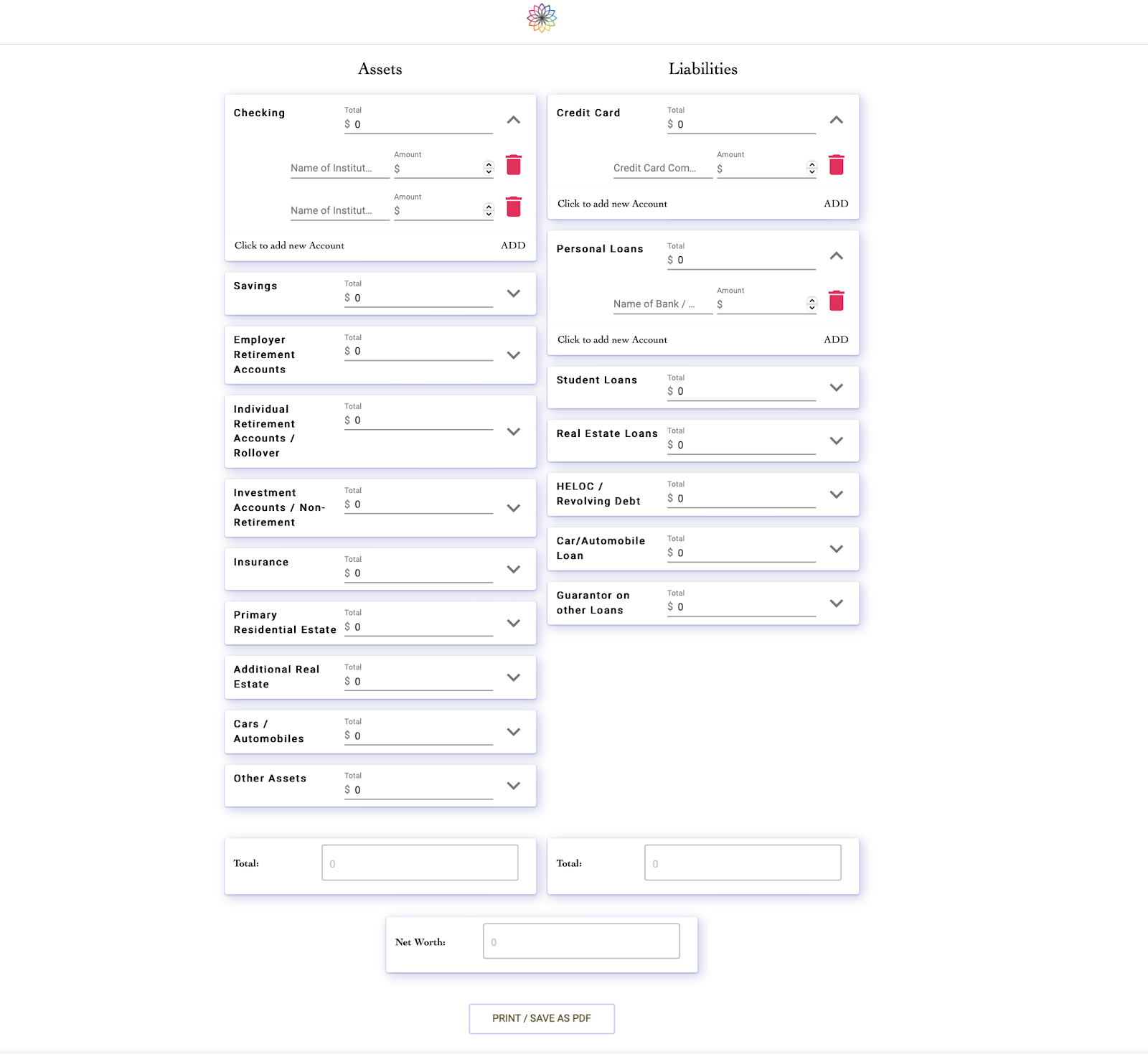

Net Worth Calculator

Understanding your personal net worth is essential if you want to know the financial status of your company. A personal net worth calculator will give you a comprehensive overview of all of your assets and liabilities. This includes things like bank accounts, investments, real estate holdings and any debts that you may have. This type of calculator will help you understand where and how the money, assets and liabilities are distributed. Most lenders would also require a Personal Financial Statement

Equipment Loan Calculator

For businesses looking to purchase new equipment or upgrade existing equipment in order to increase operational efficiency or expand product offerings/services provided, a business equipment loan calculator can provide an estimate of what could be borrowed based on current market rates and repayment terms available on similar types of equipment purchases. This type of calculator helps entrepreneurs make informed decisions about what type of equipment they should invest in based on their specific goals and budget constraints so they don’t overextend themselves financially while still being able leverage technology advancements in order grow their businesses successfully over time.

Financial calculators are powerful tools that allow entrepreneurs and business owners alike take control over their finances by providing them with accurate estimates based on current market conditions so they can make sound decisions when it comes time investing in new ventures or expanding existing ones — all while keeping an eye out for potential pitfalls along the way! With so many different types of calculators available today — from personal net worth calculators all the way up through commercial real estate loan calculators — there’s no doubt something out there tailored specifically towards helping manage whatever financing needs arise during your journey as an entrepreneur! Leveraging these tools effectively can mean the difference between success and failure when navigating complex financial situations!

Equipment Loan Calculator

For businesses looking to purchase new equipment or upgrade existing equipment in order to increase operational efficiency or expand product offerings/services provided, a business equipment loan calculator can provide an estimate of what could be borrowed based on current market rates and repayment terms available on similar types of equipment purchases. This type of calculator helps entrepreneurs make informed decisions about what type of equipment they should invest in based on their specific goals and budget constraints so they don’t overextend themselves financially while still being able leverage technology advancements in order grow their businesses successfully over time.

Financial calculators are powerful tools that allow entrepreneurs and business owners alike take control over their finances by providing them with accurate estimates based on current market conditions so they can make sound decisions when it comes time investing in new ventures or expanding existing ones — all while keeping an eye out for potential pitfalls along the way! With so many different types of calculators available today — from personal net worth calculators all the way up through commercial real estate loan calculators — there’s no doubt something out there tailored specifically towards helping manage whatever financing needs arise during your journey as an entrepreneur! Leveraging these tools effectively can mean the difference between success and failure when navigating complex financial situations!